By Cheryl Daily, Brokerage Director

Succeeding in Open Enrollment: Your Path to Confidence

Open enrollment, for business owners, can often feel like a complex maze filled with challenges and opportunities. As we venture into this annual endeavor, our goal is clear: to provide the best benefits to our employees while securing the financial health of our company. In this guide, we’ll embark on a journey together, unraveling the intricacies of open enrollment. From managing costs, ensuring employee satisfaction, and navigating regulations to harnessing technology, empowering retirement planning, and prioritizing employee well-being, we’ll equip you with the insights and strategies needed to confidently master open enrollment. Whether you’re a seasoned entrepreneur or just starting, this guide will be your trusted companion in this critical endeavor, helping you pave the way to success for both your business and your employees.

Cost Management for Business Sustainability:

Balancing costs is a primary concern for business owners during open enrollment. According to data from KFF (Kaiser Family Foundation) for 2022, the average annual premiums for employer-sponsored health insurance provide insight into the magnitude of this challenge. For single coverage, the average premium is $7,911, while for family coverage, it rises to a substantial $22,463. Notably, these amounts closely resemble the premiums reported in 2021 ($7,739 for single coverage and $22,221 for family coverage).

What’s particularly striking is the trend in the rise of average family premiums over recent years. Since 2017, the average family premium has increased by 20%, and since 2012, it has surged by a substantial 43%. These statistics underscore the growing financial burden on both employers and employees, making it imperative to explore creative and innovative cost-sharing strategies during open enrollment to ensure fairness and sustainability.

Furthermore, customization remains pivotal in this context. Tailoring benefits packages to meet individual preferences becomes even more crucial when faced with such escalating costs. This not only addresses the financial concerns but also fosters employee satisfaction, loyalty, and commitment to the company. By aligning benefit costs with employee needs and offering personalized solutions, businesses can create a win-win scenario where both employees and the company can thrive financially and strategically during open enrollment.

Employee Satisfaction and Retention:

In today’s business landscape, retaining valuable talent is paramount. Employee benefits play a pivotal role in this endeavor, as evidenced by data from EBRI (Employee Benefit Research Institute). According to EBRI, health insurance, with a remarkable 73% importance rating, and retirement savings plans, with 65%, are the most critical factors influencing employees’ decisions to stay in their current job or explore new job opportunities.

This statistic underscores the significant impact that benefits, including health insurance and retirement plans, have on job satisfaction and retention. When employees perceive their well-being as a priority, they are more likely to remain loyal to the company. To address this challenge effectively, we concentrate on aligning our benefits with employees’ needs and expectations during open enrollment. We take a personalized approach by offering customizable benefits that cater to individual preferences, reaffirming our commitment to retaining our current workforce while also attracting top talent.

Investing in employee wellness and financial security is another facet of our commitment, further supported by EBRI’s findings. A healthy and supported workforce is more engaged and dedicated, which leads to lower turnover rates, reduced recruitment and training costs, increased productivity, and a stable, experienced team.

Regulatory Compliance and Transparent Communication:

Navigating the intricate web of regulations, including the Affordable Care Act (ACA), is not just a legal obligation but also an opportunity to demonstrate ethical leadership. In today’s business environment, staying compliant with healthcare regulations is paramount, as non-compliance can result in costly penalties and damage to your company’s reputation.

One key aspect of ACA compliance involves understanding the potential penalties for non-compliance. As of 2023, these penalties vary depending on the type and severity of the violation:

- 4980H(a) penalty: If an employer doesn’t offer minimum essential coverage to at least 95% of full-time employees and one receives a premium tax credit (PTC), the penalty is $229.17 per month or $2,750 annually per employee (after the first 30 employees).

- 4980H(b) penalty: If an employer offers Minimum Essential Coverage (MEC) but it’s unaffordable or doesn’t provide minimum value, and an employee receives a PTC, the penalty is $343.33 per month or $4,120 annually per affected employee.

- Failure to file penalty: Late ACA information returns face a $280 penalty, increasing to $570 for intentional disregard of filing responsibilities.

Transparent communication is the bridge that ensures your employees understand their benefit options and can make well-informed choices while also helping them comprehend the implications of these penalties. Recent survey data from PPLSI (PPL Solutions) highlights that 81% of employees expressed a desire for year-round information about their employee benefit options and how specific plans can assist with major issues of the moment (e.g., student debt, data breaches, financial protection, etc.). This statistic supports the notion that offering a diverse benefits portfolio is not enough—employers must take the additional step of ensuring awareness and demonstrating relevance during open enrollment.

Streamlined Administration through Technology:

Efficient benefits administration is a cornerstone of a successful open enrollment period. According to a study by Aberdeen Research, technology plays a pivotal role in transforming this process. By leveraging technology, organizations can significantly reduce the administrative burden associated with open enrollment.

The study highlights that organizations can expect to recover between 70 percent and 90 percent of the time spent on administrative tasks through the implementation of technology, which we view as another cost-saving area. Moreover, this research points out a concerning issue in benefits administration: up to 15 percent of invoices from benefits carriers contain serious errors, and some experts believe the actual error rate may be even higher. In fact, the study reveals that error rates can be as high as 25 percent on some open enrollment applications. These mistakes not only create operational inefficiencies but can also lead to regulatory compliance issues that impact an employee’s ability to receive required medical coverage.

Traditionally, changes to benefits tied to onboarding, pay raises, policy renewals, or offboarding, as well as life changes like marriage or childbirth, have required HR and benefits professionals to manually reconcile premium invoices from benefits carriers and ensure the accuracy of employee enrollments and payroll data. This labor-intensive process is prone to errors and inefficiencies. However, as highlighted by the study, the adoption of technology solutions is crucial for organizations to streamline benefits administration, reduce error rates, and enhance compliance, ultimately making the open enrollment process more efficient and accurate.

Empowering Retirement Planning:

Empowering employees to make informed decisions about their retirement planning during open enrollment is a strategic investment in their long-term financial well-being. Recent research from the Employee Benefit Research Institute (EBRI) sheds light on the sobering reality: 57% of U.S. workers have less than $25,000 in total household savings and investments, excluding their homes.

This statistic underscores the critical importance of offering resources and support related to retirement planning. During open enrollment, it becomes imperative to consider providing access to retirement planning tools, educational materials, and retirement savings options. When employees have the knowledge and tools to plan for their retirement, they become more financially literate and confident about their future.

This focus on retirement planning is not just about individual financial security; it’s a forward-thinking strategy that promotes the well-being of both employees and the broader community. A workforce that is well-prepared for retirement not only benefits individual employees but can also reduce the strain on government social safety nets.

Customized Benefits and Reliable Partnerships:

Recognizing the unique needs of each employee is pivotal in creating a benefits program that resonates during open enrollment. According to a recent survey conducted by SHRM in 2023, a substantial 60% of employees rated benefits as a very important contributor to job satisfaction. This statistic underscores the significance of providing a benefits package tailored to individual preferences. During open enrollment, it becomes essential to highlight the flexibility of your benefits offerings, showcasing the various options available. This personalized approach not only enhances employee satisfaction but also promotes a sense of value and appreciation among your workforce.

However, the same survey also revealed a critical aspect of the benefits landscape. Only 27% of employees were very satisfied with their benefits communication, and a mere 22% were very satisfied with the benefits enrollment process. This suggests that employees not only care about the quality and variety of benefits offered by their employers but also the reputation and reliability of the benefits provider. Thus, building reliable partnerships with trusted benefit providers is essential. Collaborating with reputable partners who share your dedication to quality ensures that your employees have access to top-notch benefits and support. These partnerships instill confidence and security in your employees, as they know they can rely on the benefits you offer. Trusted partnerships also provide peace of mind for the HR team, knowing that they can depend on these providers to deliver as promised.

Equitable Cost-Sharing and Compliance Vigilance:

Maintaining fairness in cost-sharing during open enrollment is fundamental to building trust and ensuring the sustainability of your benefits program. According to a survey conducted by Cigna in 2021, a significant 74% of employers identified complying with federal and state healthcare regulations as a top challenge for their business. This statistic underscores the importance of staying vigilant about changes in healthcare and benefits regulations during open enrollment.

Equitable distribution of benefit costs demonstrates your commitment to treating all employees fairly and equally. During open enrollment, be transparent about the cost-sharing structure, explaining how contributions are determined. This transparency not only promotes trust but also helps employees understand the value of the benefits they receive in return for their contributions.

Moreover, the Cigna survey highlights the ongoing challenge of navigating complex healthcare regulations. Staying current with evolving laws and regulations is a critical aspect of open enrollment. Regularly reviewing and updating your plan to align with legal requirements not only safeguards your business from potential legal issues but also demonstrates your responsiveness to the evolving regulatory landscape. It shows employees that you take your legal obligations seriously and are committed to providing benefits that meet all legal standards.

Prioritizing Employee Well-being:

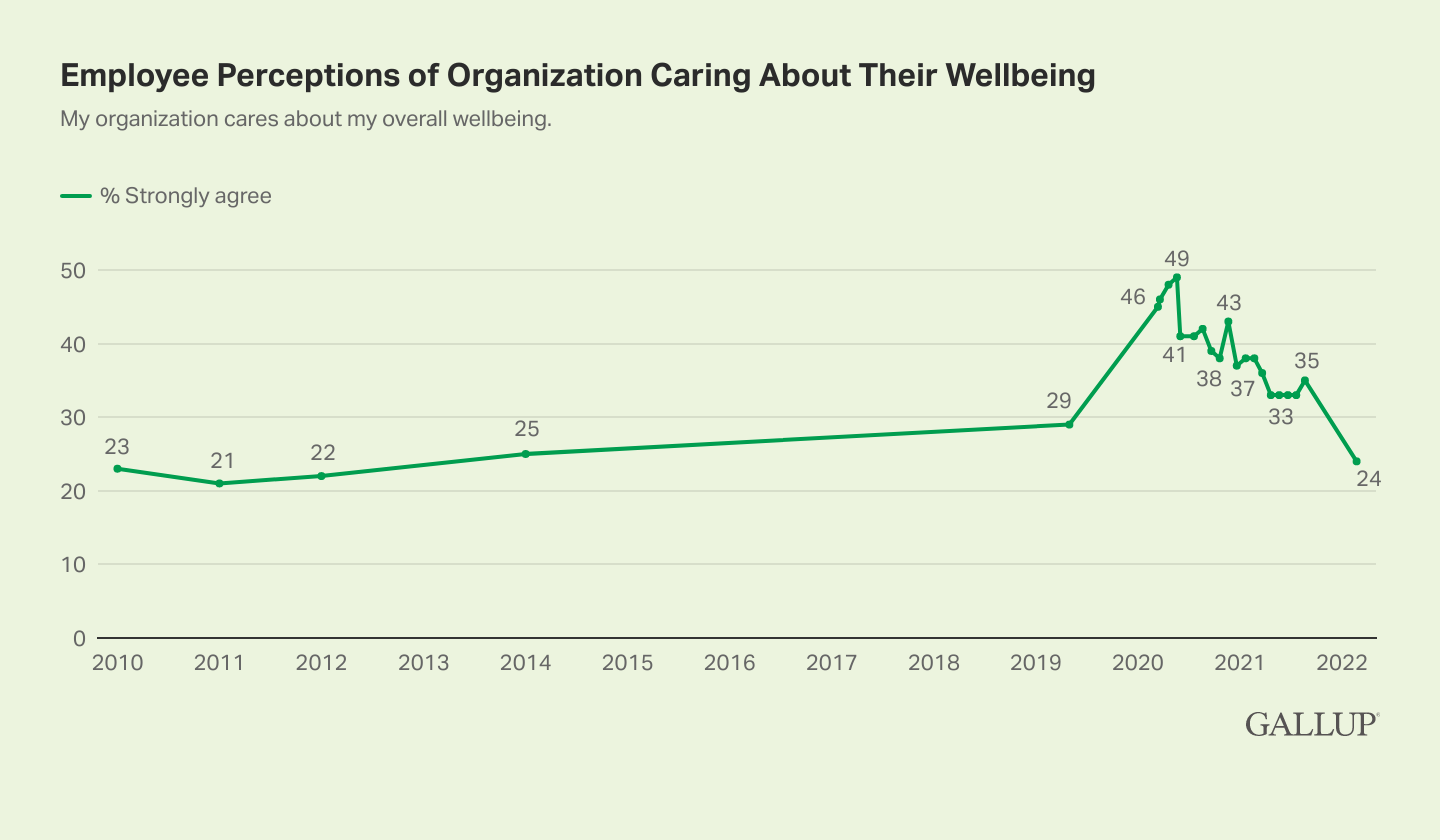

Employee well-being, encompassing physical and mental health, is a strategic investment that can yield significant returns during open enrollment. According to a study conducted by Gallup in February 2022, employees who feel supported in their well-being are likely to exhibit a range of positive outcomes:

(Image from Gallup)

- They are 69% less likely to actively search for a new job, demonstrating increased job retention and loyalty.

- 71% are less likely to report experiencing a lot of burnout, indicating improved mental and emotional health.

- They are five times more likely to strongly advocate for their company as a place to work and to strongly agree they trust the leadership of their organization, contributing to a positive employer brand and organizational culture.

- They are three times more likely to be engaged at work, leading to higher productivity and job satisfaction.

- Additionally, they are 36% more likely to be thriving in their overall lives, highlighting the positive ripple effects of prioritizing employee well-being.

Prioritizing employee well-being during open enrollment isn’t just a matter of corporate responsibility; it’s a proactive approach that benefits both your workforce and your company’s bottom line. According to a WHO-led study, every U.S. $1 invested in scaling up treatment for depression and anxiety leads to a return of $4 in better health and ability to work, highlighting the substantial impact of addressing mental health during open enrollment.

In conclusion, mastering open enrollment isn’t just a necessity; it’s a strategic imperative for businesses aiming to thrive in a competitive landscape. By effectively managing costs, prioritizing employee satisfaction and retention, staying compliant with regulations, streamlining administration through technology, empowering retirement planning, offering customized benefits, ensuring equitable cost-sharing, and prioritizing employee well-being, businesses can navigate the open enrollment maze with confidence.

These strategies, backed by data and research, not only safeguard your company’s financial health but also cultivate a loyal and engaged workforce. It’s a win-win scenario where employees feel valued, and the business operates within the bounds of the law. Remember, open enrollment is not just an annual task; it’s an ongoing commitment to your employees’ well-being and your company’s success.

For personalized assistance in optimizing your open enrollment process, reach out to our experts at info@lever1.com. We’re here to help your business thrive, one enrollment at a time.